Questions about tariffs and electronics manufacturing are becoming more common, particularly for companies managing cross-border supply chains or reassessing long-term production models. Shifts in global trade policy have prompted many OEMs to re-evaluate their manufacturing and sourcing strategies.

The questions below reflect what manufacturers are encountering in practice, how tariff exposure typically affects electronics production, and which structural decisions tend to reduce uncertainty over time.

Are Canadian electronics manufacturers affected by U.S. tariffs?

Canadian electronics manufacturers are not automatically subject to U.S. tariffs simply by operating in Canada. Tariff exposure depends less on facility location and more on how materials and products move through the supply chain.

In practice, exposure is influenced by:

- Where electronic components originate

- Whether parts or assemblies cross U.S. borders during production

- The declared country of origin for imported materials

- The destination market for finished products

Manufacturers serving primarily Canadian markets often experience lower direct exposure. Products that cross borders multiple times during assembly or integration typically face more variability.

Do tariffs increase cost volatility for Canadian OEMs?

They can, depending on how supply chains are structured.

Cost volatility most often appears when:

- Key components are sourced from tariff-affected regions

- Supply chains rely on frequent cross-border transfers

- Lead times depend on customs clearance and regulatory reviews

Manufacturers working with domestic production partners often experience fewer tariff-related variables. While component sourcing remains global in many cases, keeping assembly and integration within Canada tends to support more predictable pricing and scheduling.

Are electronics components subject to tariffs?

Some components are.

Tariff exposure is determined by:

- Harmonized System classification

- Country of origin

- Trade agreements in effect at the time of import

Electronic components, sub-assemblies, and metal enclosures may be subject to tariffs depending on sourcing and destination. Because classifications and policies change, manufacturers typically monitor these factors continuously rather than treating tariff exposure as a fixed condition.

How do tariffs affect PCB assembly and box build pricing?

Tariffs generally do not apply to the assembly service itself. Instead, they affect the materials entering the production process.

Pricing impact most often comes from:

- Imported electronic components

- Internationally sourced metal enclosures or fabricated parts

- Power supplies or specialized sub-assemblies

- Products that cross borders between manufacturing stages

When electronics assembly and enclosure fabrication are managed domestically, tariff-related variability is often easier to track and forecast. Integrated production models also simplify documentation and compliance.

Are manufacturers reshoring or nearshoring electronics production to Canada?

Many are evaluating it.

Reshoring or nearshoring decisions are rarely based on labour cost alone. Manufacturers are weighing broader operational factors such as:

- Supply chain visibility

- Engineering communication

- Revision control

- Logistics complexity

- Risk exposure tied to border movement

In many cases, the decision is not about reacting to a single tariff change but about reducing long-term uncertainty across the production lifecycle.

Is electronics manufacturing in Canada more stable under current trade conditions?

For companies serving Canadian or North American markets, domestic manufacturing can offer structural advantages.

These often include:

- Fewer border-related delays

- Reduced tariff exposure points

- More predictable logistics

- Alignment with Canadian regulatory requirements

Stability does not mean insulation from global supply conditions. Electronic components are still sourced internationally. However, limiting cross-border movement during assembly and integration reduces the number of variables that can disrupt production.

How are manufacturers reducing tariff-related supply chain risk?

Manufacturers are responding with practical, structural changes rather than short-term adjustments.

Common approaches include:

- Diversifying component suppliers

- Increasing domestic sourcing where feasible

- Consolidating assembly and integration under one manufacturing partner

- Improving demand forecasting and inventory planning

- Monitoring trade classifications and regulatory updates

These strategies focus on visibility and control rather than prediction.

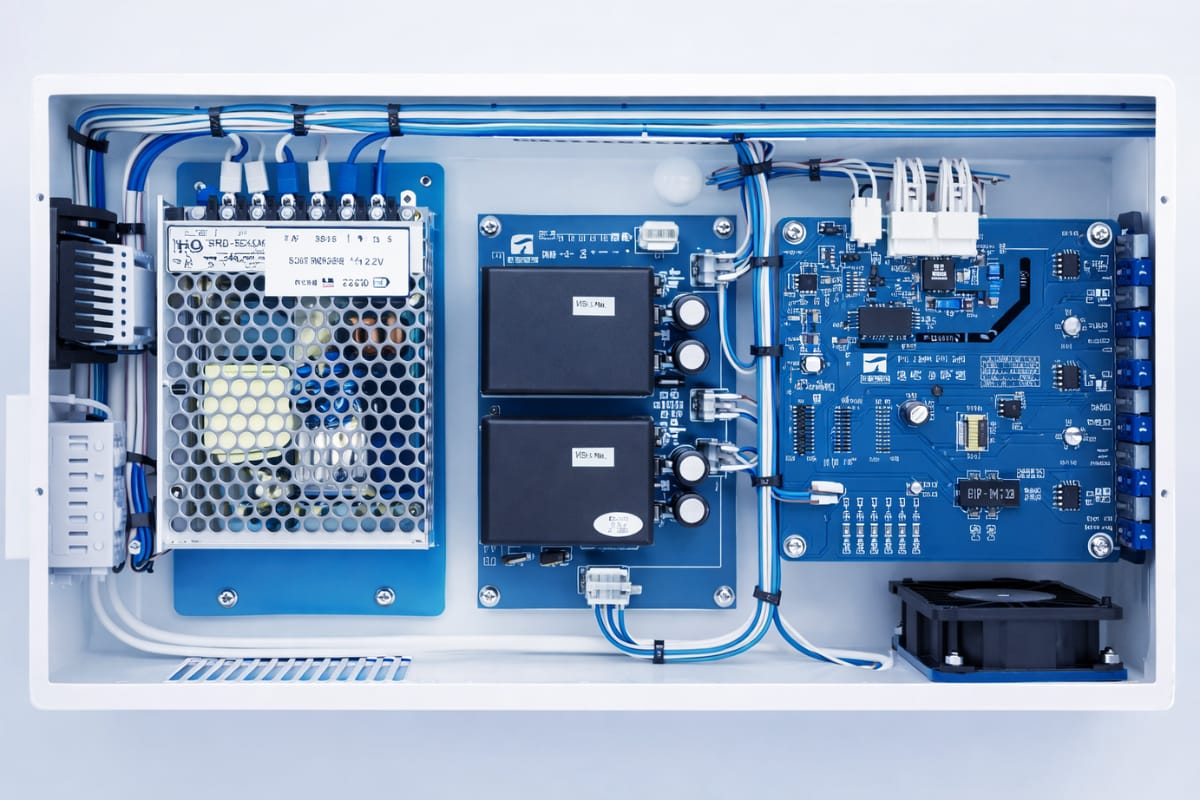

What role does integrated manufacturing play in managing tariff exposure?

Integrated manufacturing reduces the number of handoffs and border crossings within the production process.

When PCB assembly, enclosure fabrication, system integration, and testing are coordinated within a single workflow, manufacturers can:

- Minimize cross-border transfers

- Simplify documentation and compliance

- Reduce revision misalignment

- Improve cost predictability

Fewer transitions between vendors typically mean fewer tariff exposure points and clearer accountability when conditions change.

Why are some Canadian manufacturers prioritizing domestic growth?

This shift reflects operational discipline rather than policy reaction.

Manufacturers are focusing on:

- Optimizing capacity within Canada

- Strengthening domestic supplier relationships

- Serving local and national markets more efficiently

In uncertain trade environments, predictability often matters more than marginal cost advantages.

Evaluating Tariffs and Electronics Manufacturing in Canada

Tariffs and electronics manufacturing do not present a uniform challenge. Exposure depends on sourcing strategy, product destination, and supply chain structure.

Manufacturers reviewing their production models typically focus on:

- Understanding component origin

- Mapping cross-border movement

- Consolidating manufacturing where possible

- Prioritizing transparency and engineering alignment

A disciplined manufacturing strategy reduces uncertainty, even as trade conditions continue to evolve.

For organizations evaluating electronics manufacturing in Canada, integrated production and controlled supply chains often reduce exposure to shifting trade conditions. IMS supports OEMs with integrated electronics and enclosure assembly designed for long-term predictability.