There’s an increasing demand for active electronic components due to the widespread and growing use of connected devices, an expansion in industrial automation, and a demand for electric vehicles. These factors are driving steady growth in the active electronics component market. New products are continuously developed, offering innovative solutions to users.

What is an active electronic component?

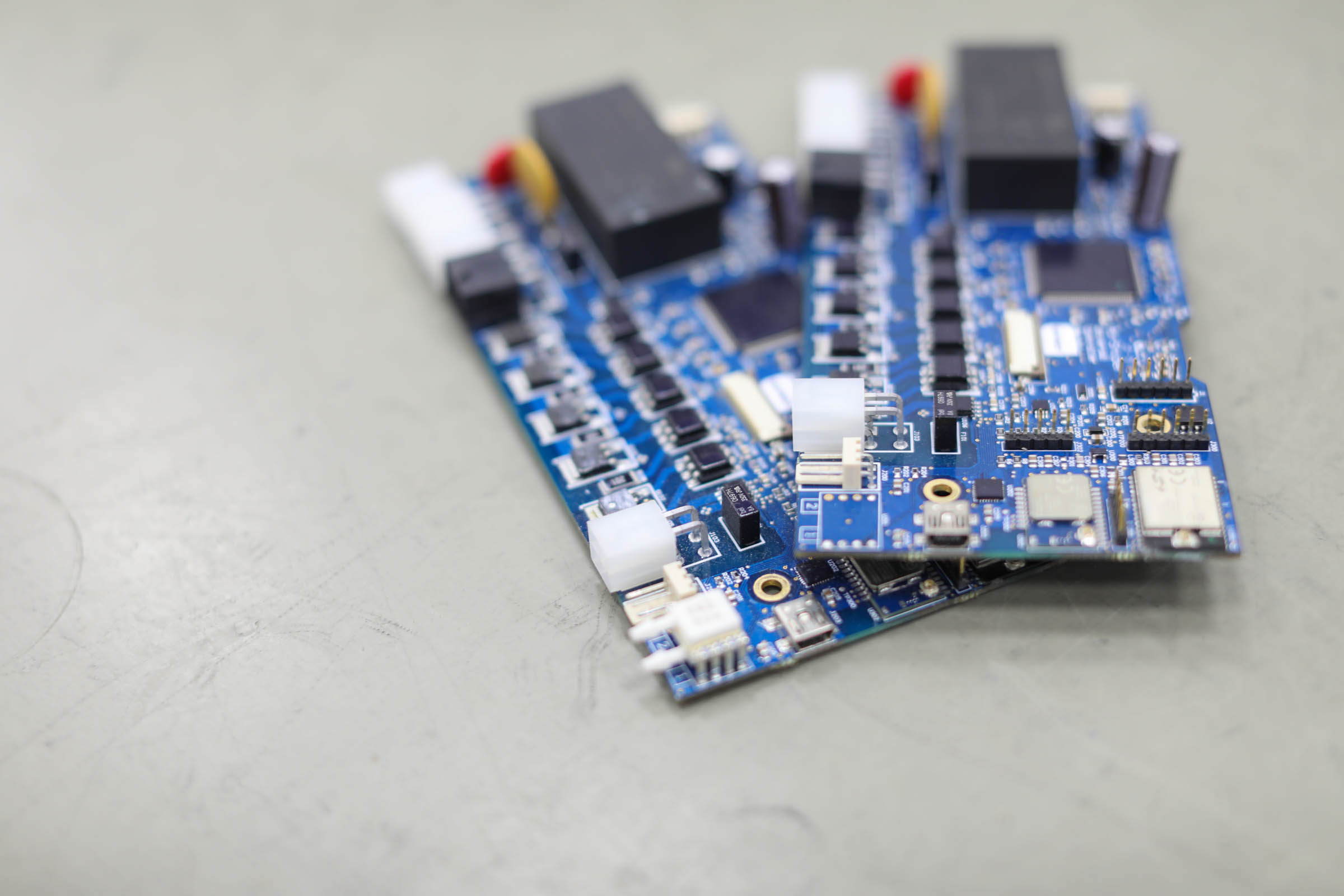

An active electronic component is a device that regulates electricity flow (supplies energy and amplifies electrical signals). You’ll find one or more electronic components on every printed circuit board (non-conductive board with printed and/or etched lines containing traces that connect components to form a circuit and/or assembly). Printed circuit boards are used in almost all electronic products (smartphones, radios, tablets, computers, household appliances, medical equipment, televisions, gaming consoles, security systems, smart meters, digital cameras, etc.). This makes active electronic components an essential part of everyday life. Japan, India, and China are the main producers of active electronic components.

The global active electronic components market:

In 2022, the global active electronic components market was valued at $304.3 billion US. The expected growth rate from 2023 to 2030 is 6.6%. The semiconductor segment of the market has the largest share and is expected to expand at a compound annual growth rate of 7.1%. The consumer electronics section of the market is projected to increase at a compound annual growth rate of 7.6%.

Who are the key companies in the electronic component market?

Key companies in the electronic component market invest heavily in development and research. The automotive industry has boosted competition among these companies as they pursue strategic measures and product launches in an attempt to capture market share and improve profitability. The key players include:

- Samsung Semiconductor Inc. (developer of smartphones and consumer electronics, computing platforms)

- Qualcomm Inc. (a company of inventors with diverse backgrounds and skills)

- SK Hynix Inc. (maker of memory chips and supplier of semiconductors)

- NXP Semiconductors N.V. (semiconductor designer and manufacturer)

- Intel Corporation (manufacturer of semiconductor computer circuits)

- Broadcom Inc. (designer, developer, manufacturer, and supplier of a range of semiconductor and infrastructure software products.)

- Texas Instruments Incorporated (a global semiconductor company)

- Analog Devices, Inc. (semiconductor company specializing in signal processing, data conversion, and power management technology)

- Infineon Technologies AG (global leader in automotive, power management, energy-efficient technologies)

- Advanced Micro Devices, Inc. (provider of CPU technology for desktop computers)

- STMicroelectronics N.V. (a manufacturer and provider of semiconductors)

- Microchip Technology, Inc. (leading provider of smart, secure and connected embedded control solutions)

- Semiconductor Components Industries, LLC (designer and manufacturer of semiconductors components)

- Monolithic Power Systems, Inc. (provider of high-performance, semiconductor-based power electronics solutions)

- Renesas Electronics Corporation (a global leader in microcontrollers, analog, power, and SoC products)

- Toshiba Corporation (manufacturer of computers and electronic devices for consumers and industry)

- Onsemi (a leading manufacturer of semiconductors)

- Hon Hai Technology Group (electronics manufacturer)

What’s new in the electronic component market?

The electronic component market is an ever-expanding constantly changing landscape. The following are some of the most recent innovations:

- The automotive industry: A rapidly growing market for electric vehicles and increasing use of autonomous vehicle technologies (parking assist, telematics, navigation, safety airbags, etc.) is promoting growth in the electronic component market as is the increasing demand for premium and luxury vehicles.

- NXP Semiconductors (semiconductor designer and manufacturer), in collaboration with Hon Hai Technology Group (electronics manufacturer), is creating platforms for a new wave of smart, connected vehicles.

- May 2023 saw NIO (Chinese, multinational, automobile manufacturer) and NXP (semiconductor designer and manufacturer) join forces allowing NIO to extend detection range, improve sensor resolution, and enable high levels of autonomous driving.

- Onsemi (a leading manufacturer of semiconductors) introduced a low-power, automotive wireless microcontroller with Bluetooth connectivity.

- In January 2023, Renesas (a global leader in microcontrollers, analog, power, and SoC products) introduced an automotive intelligent power device that flexibly and safely controls the distribution of power in vehicles.

- In April 2023, Infineon Technologies (global leader in automotive, power management, and energy-efficient technologies) revealed the first Low-Power Double Data Rate memory that enables next-generation automotive EE-architectures (the system that connects in-vehicle ECUs, sensors, actuators, etc.).

- Asset tracking solutions:

- June 2023 saw Onsemi (a leading manufacturer of semiconductors) introduce an end-to-end positioning system resulting in faster, simpler development of cost-effective, accurate, power-efficient asset tracking solutions.

- June 2023 also saw a collaboration of Onsemi (a leading manufacturer of semiconductors), Unikie (a software development company), and Corel-HW (a software development company) that resulted in the introduction of another end-to-end positioning system that promotes faster, simpler development of cost-effective, power-efficient solutions.

- Qualcomm (a company of inventors with diverse skills and backgrounds) has a new satellite Internet of Things (IoT) solution able to provide asset tracking and uninterrupted remote monitoring.

- Artificial intelligence is increasing in popularity among consumers, particularly generative AI. Many companies are developing their chips in support of new AI inferences and large data centers.

- TSMC (semiconductor manufacturing company) is investing $2.87 billion to build a plant specializing in advanced packaging of high-performance semiconductors for generative AI.

- Meta (American multinational technology conglomerate) announced the development of a custom chip family for powering data centers and AI projects. This undertaking is meant as a learning experience to guide future chip development aimed at updated AI-oriented cooling and networking systems.

- Quantum chips serve as the processors for quantum computers that are used in university research labs. These computers take seconds to solve complex problems that traditional computers would require years to unravel. Intel (an American semiconductor chip manufacturer) has developed a new type of quantum chip (Tunnel Falls) that they hope to use in the development of a full-stack commercial quantum computing system. More advances in the quantum chip field are expected, bringing quantum computers closer to practicality.

- 5G infrastructure: The introduction of active electronic components in the production of communication and network equipment for 5G infrastructure is increasing the demand for electronic components. June of 2023 saw NXP’s top-side cooling packaging for RF power allow for thinner, smaller, lighter radio units, enabling quick and easy usage of 5G base stations.

- GDDR7 DRAM Chip: Samsung (producer of electronic devices) created the first GDDR7 DRAM chip with faster speeds and improved power efficiency (1.5TBps of bandwidth which was a 40% increase over GDDR6 chips and per-pin speed of 32GBps which is a 33% increase). The new chip will be utilized in areas requiring excellent graphics performance (workstations, game consoles, PCs) and will expand into future applications (AI, high-performance computing (HPC), automotive vehicles). They’ll be testing the chip in 2023. Other chip manufacturers are also working on final versions of GDDR7.

- Switches: STMicroelectronics (a manufacturer and provider of semiconductors) introduced a group of octal high-side switches in June 2023. Combined with galvanic isolation, these switches increase energy efficiency, troubleshooting, protection diagnostics, and reliability.

There’s a rapidly increasing demand for renewable energy and electrification as well as a rising interest in artificial intelligence that is promoting advancement in the electronic component industry. This trend is expected to increase exponentially in the future. Electronic component makers will likely rise to the challenge with innovative ideas and products.

Need circuit board/cable assembly and/or custom sheet metal fabrication services? Are you looking to scale your operations? Require troubleshooting and/or testing? Need process and/or production support? Contact Innovative Manufacturing Source (IMS). Our Calgary-based team of skilled, knowledgeable, dedicated people offer unsurpassed product and service. We assist you through in-house manufacturing completed on state-of-the-art tools/equipment. Call us at 403.279.7702. Let us be your premier provider and partner of custom metal fabrication services and electronic manufacturing for all of your needs. We support customer-specific requirements on all that we produce.